January 1, 2025 Market Note

- Joshua Henry

- Jan 5, 2025

- 5 min read

A Market Note was included at the end of our December 1 newsletter. The Market Notes we generally send with our newsletters are written in more plain language. Four other times a year we send (after the end of each quarter) a Market Note that is often more technical in nature. Now is one of those times with the fourth quarter of 2024 just ended.

There has not been a lot of material change in the economy or markets in the 31 days since the December 1 newsletter. One thing that did change the dynamics a little bit, however, has been a change in expectations of future Federal Reserve (our central bank) interest rate cuts. The market had been expecting more cuts (3 or more in 2025) and in a recent press conference, the Chair of the Federal Reserve Jerome “Jay” Powell indicated that there would be fewer cuts in 2025 than the market had been expecting (baseline of 2). That has caused market interest rates to actually backup, meaning market interest rates have increased.

During the year, it has been a little bit of a roller coaster with respect to rates, but if we view it on a year to date basis, looking at the 10 year US Treasury, which is one of the main bond benchmarks that market participants look at, the yield ended the year up 19.3% higher than it began (from 3.88% at the beginning of the year to 4.63% as of the date of this writing on the 28th). To be clear, that 0.75% change in the absolute value of the yield is 19.3% higher than 3.88%. Higher interest rates generally mean lower equity valuations, and it also means less borrowing and economic activity. At the margin, it can mean less household formation. So there are definitely headwinds, but there are tailwinds in the economy as well. We have benefited in a large way from artificial intelligence, and the associated productivity increases. Only 2 things can increase national income and national wealth.

To increase national income and national wealth, there has to be either productivity gains or population increases or both. So the productivity gains have been large. In our December 1 newsletter, we also mentioned the potential upside associated with either a reduction in tax rates or at the least a greater likelihood of avoiding increases in taxes accompanying the incoming administration. We also mentioned the potential benefits of deregulatory action, but we also mentioned the risks associated with tariffs. There's a lot of unknowns with respect to tariffs depending on how high they are and whether they are targeted or more broad-based. The Wall Street Journal recently wrote that based on the proposed tariffs, the average cost of every car sold in the US could increase by $3,000. We won’t spend too much time here, but tariffs generally tend to decrease economic activity. They tend to depress global commerce, and they generally result in countervailing tariffs (tariffs put on in response to retaliate against the initial tariffs), which can often spiral into a tit-for-tat escalating situation. So there are pluses and minuses in multiple columns from an economic perspective as we head into 2025.

If the goal of our Market Notes and newsletters was to list reasons not to invest, we could write many newsletters because those risks are almost always present. The market would not reward investors with a premium if there was no risk. And there are risks, but at present the balance between risk and return looks more favorable than not. Jeff Cox wrote for CNBC that “the economic outlook for 2025 is strong, but there is still a lot that could go wrong.” I feel like that observation could be set to evergreen as that is the song the market plays the most. And as Ali Flynn Phillips, President and partner at Obermeyer Wealth Partner said, history shows over time, it is not about timing the market, but time in the market. So holding high quality assets over time is the best way to build wealth for clients, she went on to say. She’s right. That strategy has greatly benefited those discipled enough to pursue that approach.

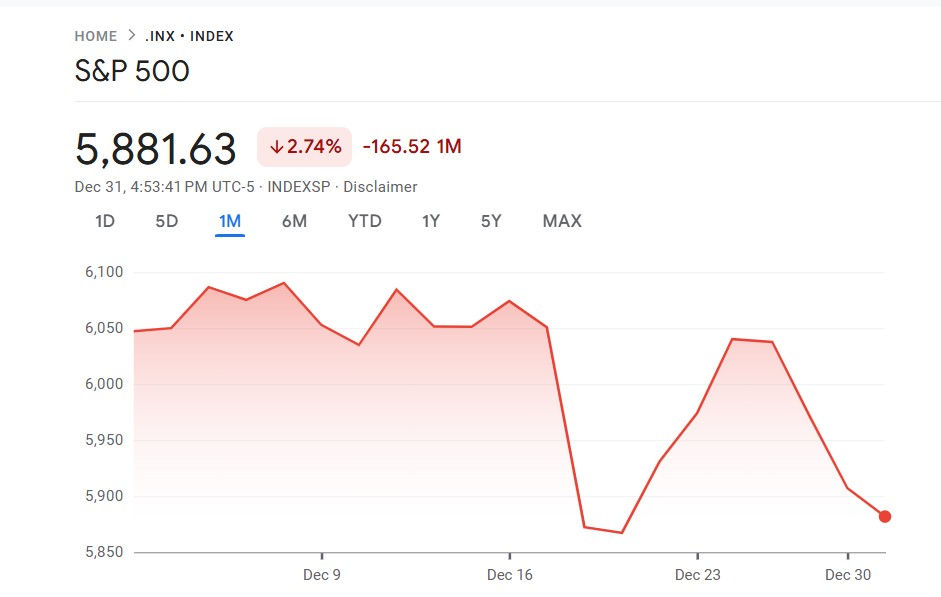

As we wrap this up, we need to acknowledge the choppiness we have seen in the market since our December 1 newsletter (see below chart).

However, giving too much credence to a 1 month time period (December 2024) would be myopic (short sighted) and not appropriate for market investing. Friday the 27th, the market pulled back considerably (the S&P 500 fell by -1.11%), but looking at the Dow Jones index, the index eked out a positive +0.4% gain which broke a 3 week losing streak. Primarily, the market needed to blow off some steam but recent words from Mr. Powell and interest rates may have been a near term catalyst. Before that 3 week losing streak, on a technical basis, the market was overbought so that pullback was actually healthy.

With that as a background, Chartered Financial Analyst and Chief Investment Officer Cameron Dawson at NewEdge Wealth on Bloomberg Surveillance recently said we should not be surprised if forward returns are less than the last 2 years. If we were to have another year like 2023 or 2024 “that would propel us into bubble territory because of where we are starting with valuations so we actually think a sideways, somewhat choppy year is the best thing for this market so it would allow us to grow into these higher valuations.”

Every Meridian client has a portfolio tailored with exposures and liquidity appropriate for their situation, and as such as we enter 2025, let us continue to proceed wisely, disciplined (relative to our strategy) and confident and build up more time in the market, allowing the strategies and exposures to work.

To learn more about Meridian's market views and how they are incorporated into investment portfolios, reach out to us to schedule an introductory phone call at (843) 212-6828 or contact@meridianria.com.

About Joshua

Joshua Henry is the founder and Managing Principal of Meridian Financial Advisory (meridianria.com), an independent, fee-based wealth management company located in South Carolina, serving people locally and across the country, that focuses on providing wealth management solutions primarily to affluent individuals over age 50 and their families. Joshua is passionate about helping people have a better life by designing and implementing customized financial plans that bring clarity and confidence. Joshua is a CERTIFIED FINANCIAL PLANNER™(CFP®), a Certified Investment Management Analyst® (CIMA®) Professional, and earned a Bachelor of Arts degree in Political Science from Cedarville University and a Master of Business Administration degree with a concentration in Corporate Finance from Salve Regina University. The courses for the Corporate Finance concentration were taken from the Kelley School of Business at Indiana University. He has held workshops on Social Security Claiming Strategies, IRA Planning, and Career Coaching for Executives in between jobs. Josh has also taught finance at the university level. When he’s not working, Josh teaches adult Sunday School at his church in Pawley Island, SC. He enjoys traveling, reading, working out and time with his family. To learn more about Josh, connect with him on LinkedIn.

Comments