July 1, 2025 Market Note

- Joshua Henry

- Sep 12, 2025

- 4 min read

July is here and we hope everyone is doing well. We wanted to write to let you know your quarterly statements for the quarter ended June 30 will be placed in your Box accounts within the next several days. We also wanted to provide a Market Note.

It has not been too many days since our last Market Note, sent in our June newsletter but there are some new observations and comments.

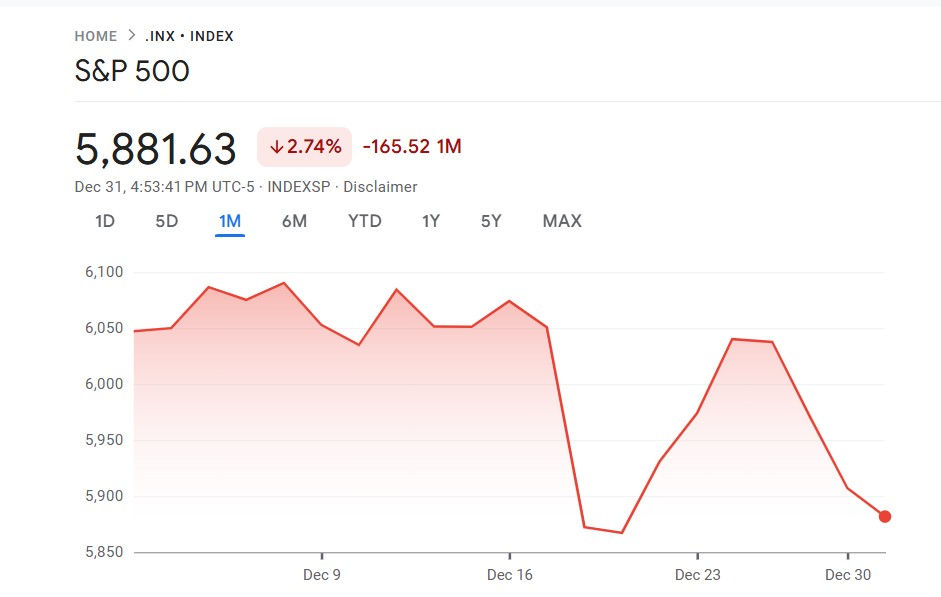

At the time of our most recent Market Note (early June), the S&P 500 (the best of the major indices in representing the US stock market) was trading at 6005. Yesterday, the S&P 500 closed the second quarter at 6204.95. I am including a chart of the S&P 500 year to date below.

April was when the market fell off a cliff due to growth concerns and tariff concerns. But even before April was over and following into May, we saw a sharp recovery in the market due to easing of concerns on both of those fronts. While there has justifiably been an easing of those concerns, as is frequently the case, the economic data is mixed. There are positive signals and negative signals. Some of the softening data includes the following:

-continuing jobless claims are not at bad levels but they are rising and recurring applications for unemployment benefits are at the highest level since 2021.

-layoff rates remain low but so is the hiring rate.

-consumer spending fell in May

-the Bloomberg fear and greed index hit the highest level of greed since March of 2024.

-while the broad market indexes have done well, there is not broad participation by most listed companies as evidenced by the ratio of the equal weighted S&P 500 to the cap weighted S&P 500.

The most recent market impacting event has been a geopolitical one, namely the conflict with Iran. Generally, markets recover quickly following geopolitical scares. When it comes to digesting and thinking about how the recent conflict with Iran and strikes on their nuclear facilities impact the markets, we would like to summarize the thoughts of two different well respected asset managers (Carson Group & Charles Schwab), Ryan Detrick, Chief Market Strategist at the Carson Group and Liz Ann Sanders, Chief Market Strategist at Schwab.

Detrick has been very good about contextualizing events and markets and thus his calls have been right a lot in recent years. His advice is not to make any rash decisions about your portfolio. He went on to say that his firm continues to “suggest sticking with a diversified portfolio, which helps you sleep at night given all the headline risk we are seeing in 2025.” That is the chorus successful investors know well. In fact, the recovery we have seen since his recent comments has proved him correct, again.

As you know, Meridian Financial is a Schwab partnered firm and Charles Schwab’s own Chief Market Strategist Liz Ann Sonders (as wise, seasoned and respected as you will find) talked recently about the importance of maintaining market exposures and rebalancing (which means periodically realigning current portfolio market exposures with target exposures as they drift). That is something Meridian does for clients. And Sonders said that is absolutely the right strategy to think about and the best way to stay in gear. She further said, “if your ultimate goal is to have the bragging rights that you absolutely nailed it at the top or nailed it at the bottom, good luck with that. I guarantee that’s not going to be a successful long term strategy.”

My strong hunch is that almost invariably someone’s golfing buddy who brags about this or that great trade they made is the person who will materially underperform the market over time to the detriment of their goals, lifestyle and legacy.

We hope it is a great summer out there.

To learn more about Meridian's market views and how they are incorporated into investment portfolios, reach out to us to schedule an introductory phone call at (843) 212-6828 or contact@meridianria.com.

About Joshua

Joshua Henry is the founder and Managing Principal of Meridian Financial Advisory (meridianria.com), an independent, fee-based wealth management company located in South Carolina, serving people locally and across the country, that focuses on providing wealth management solutions primarily to affluent individuals over age 50 and their families. Joshua is passionate about helping people have a better life by designing and implementing customized financial plans that bring clarity and confidence. Joshua is a CERTIFIED FINANCIAL PLANNER™(CFP®), a Certified Investment Management Analyst® (CIMA®) Professional, and earned a Bachelor of Arts degree in Political Science from Cedarville University and a Master of Business Administration degree with a concentration in Corporate Finance from Salve Regina University. The courses for the Corporate Finance concentration were taken from the Kelley School of Business at Indiana University. He has held workshops on Social Security Claiming Strategies, IRA Planning, and Career Coaching for Executives in between jobs. Josh has also taught finance at the university level. When he’s not working, Josh teaches adult Sunday School at his church in Pawley Island, SC. He enjoys traveling, reading, working out and time with his family. To learn more about Josh, connect with him on LinkedIn.

Comments